Investment Banking Pitch Books Structure, Samples & Templates

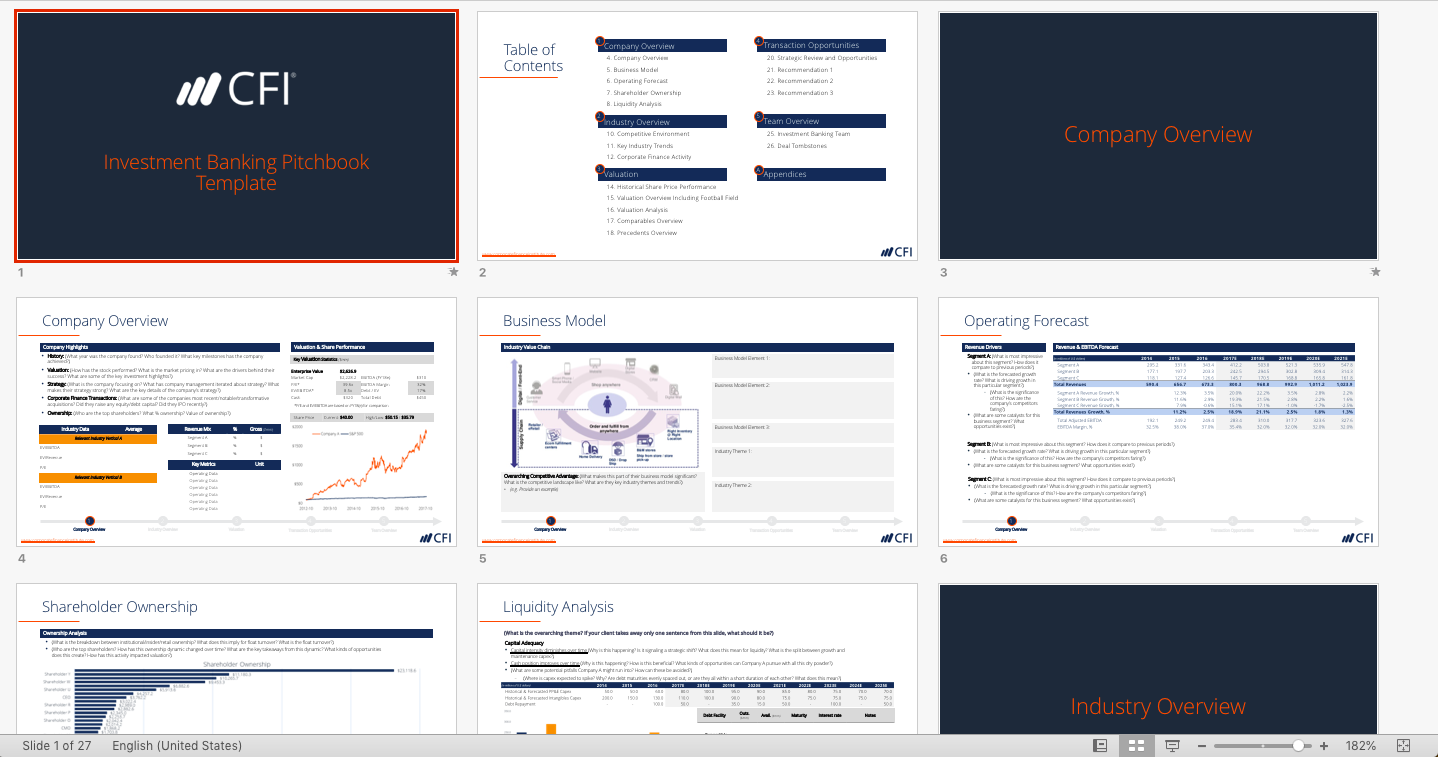

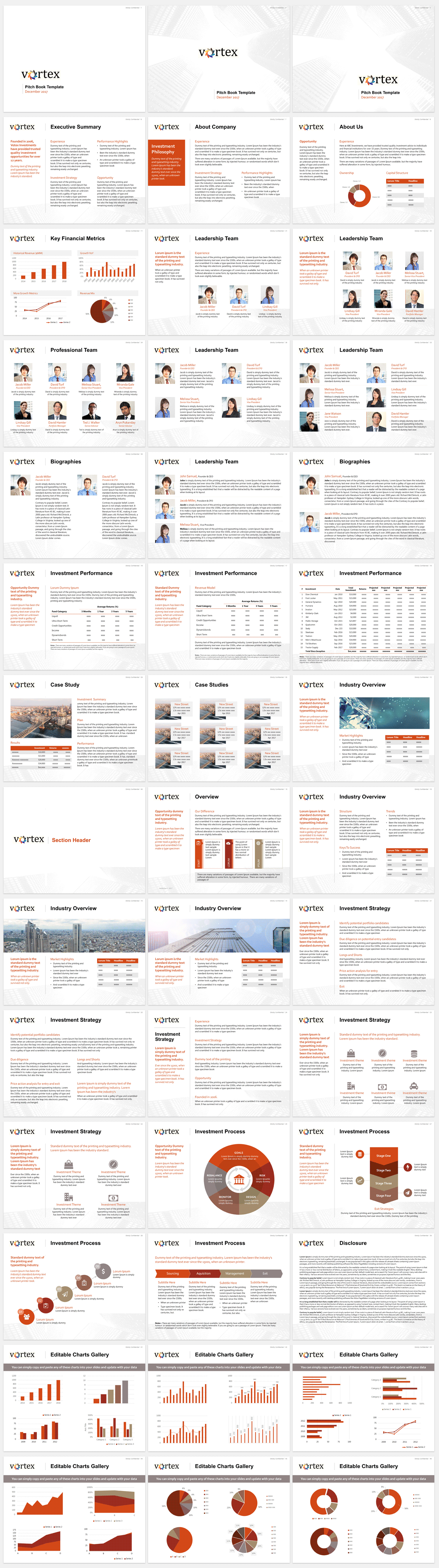

1. Market overviews / Bank introductions - (main pitch book): This type of investment banking pitch book would include all details that one needs to have about the investment firm. This would include its background details, its vision & mission statements, history, and details about management.

Investment Banking Pitch Books Structure, Samples & Templates

A pitch book (or pitch deck) is a document used by investment banks to help pitch potential transactions to current and potential clients. It is among the most important tools used by investment bankers to help sell their services.

IB (Investment Banking) Pitchbook Template Eloquens

There are two primary kinds of pitchbooks. The main investment presentation's features are the key attributes of the business, and the second one is deal-specific. The second pitchbook is used when making a presentation about a particular deal. It is used for initial public offerings and the selling of investment products.

How to Create A Business Pitchbook for Presenting Real Value

Pitch Book Presentation, Part 1: Pitching Your Team as the Advisor of Choice Pitch Book Presentation, Part 2: Providing Background and Context Pitch Book Presentation, Part 3: Choose Your Own Adventure Sell-Side Pitch Books for Sell-Side Mandates Buy-Side Pitch Book Examples Equity Pitch Book and Debt Pitch Book Examples for Financing Mandates

How do I create a great book proposal? MacGregor and Luedeke Literary

Discover the art of impactful presentations! Explore the best 8 pitch book examples to elevate your business storytelling.

Investment Banking Pitch Books Structure, Samples & Templates

1. Pitch Deck Example for Startup Tailored for entrepreneurs aiming to make a lasting impression, this startup pitch deck example exemplifies critical components essential for success. From compelling visuals to strategic content flow, it serves as a guiding example for those seeking inspiration in crafting impactful presentations.

Investment Banking Pitch Books Structure, Samples & Templates

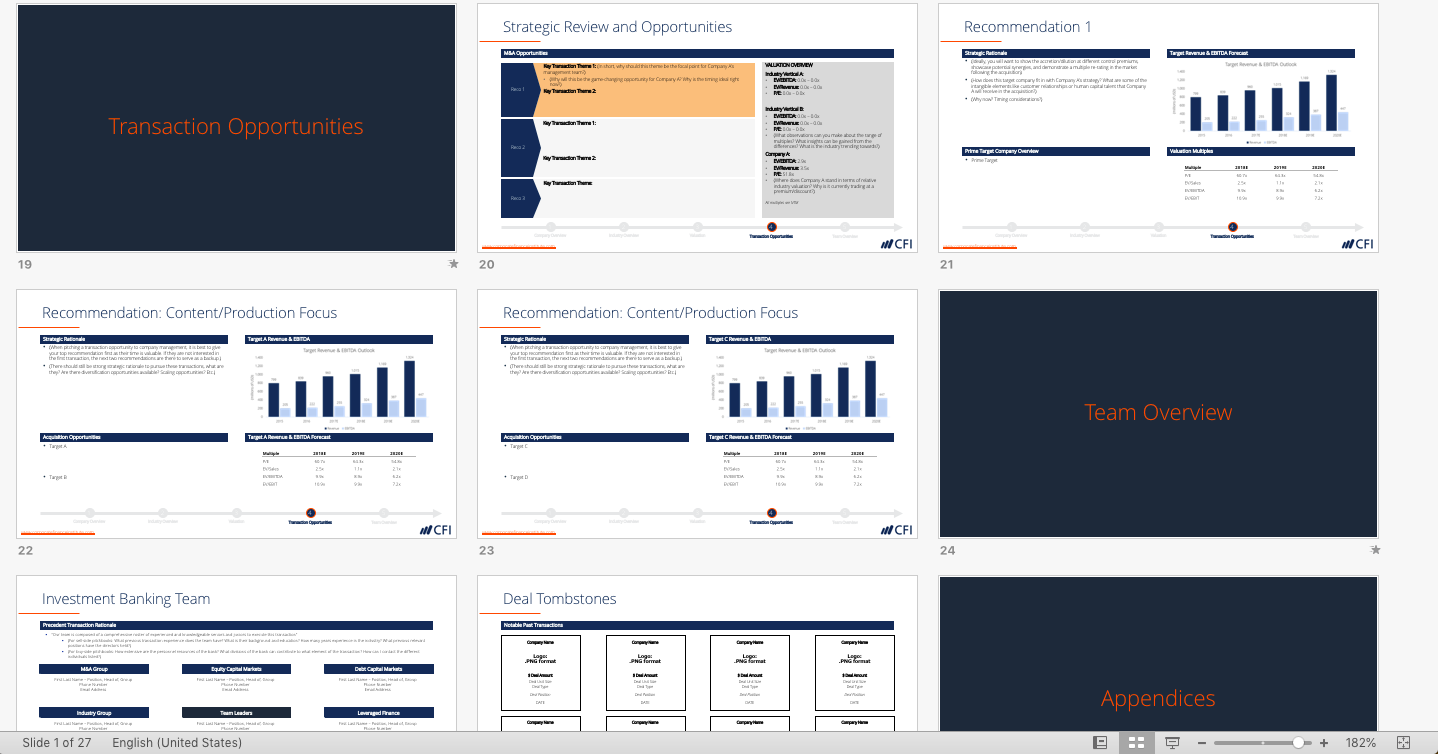

The Industry Overview section of the Pitchbook template includes: Competitive Environment Key Industry Trends Corporate Finance Activity III. Valuation The Valuation section of the Investment Banking deck includes: Historical Share Price Performance Valuation Summary (including Football Field) Comparables Overview Precedents Overview IV.

IB (Investment Banking) Pitchbook Template Eloquens

na Investment banking pitchbook: Types, examples, and tips Jan 16, 2023 A pitchbook is an essential sales tool in the investment banking process. It helps bankers pitch their services to current and potential clients. The guide below aims to explain how a pitchbook works and how to create it. What is a pitchbook?

How to Write a Book Pitch drawingprompts Pitching your story Writing words, Writing a book

Icahn/Southeastern letter assumes 1H FY14 cash flows and debt pay down of ~$0.9bn and ~$2.4bn versus company expectation of ~$0.3bn and ~$2.2bn, respectively. Assumes $6.4bn of minimum cash.

Pitch Book Template Example for Investment Banking Pitch Book (NEW)

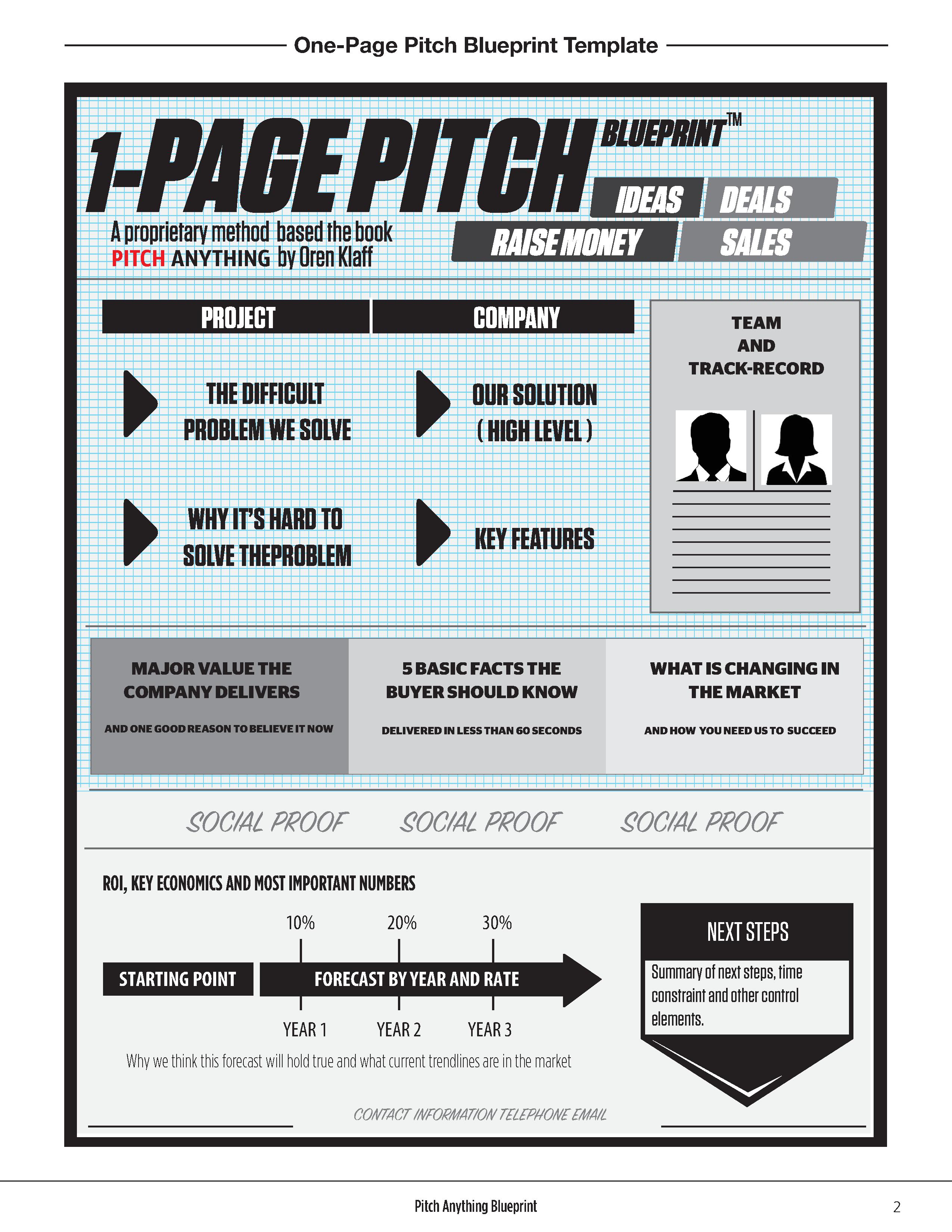

Here is an example outline for an investment banking pitch book: Title page - logos, date, and a title Table of Contents - all sections in the pitch book Executive Summary / Situation Overview - explain why you're giving the pitch and the call to action or recommendation on one page

One Page Pitch Deck Template

Key Takeaways Investment banking pitch books are structured PowerPoint presentations designed to attract new business. They articulate why the bank is the best choice for transaction processes and why clients should opt for its services.

Pitch Book Template Example for Investment Banking Pitch Book (NEW)

Written by CFI Team What is a Pitchbook? A pitchbook is a sales book used by investment banks to sell products and services, as well as to pitch potential clients. The purpose of a pitchbook is to secure a deal with the potential clients.

Pitch Book Sample Mergers And Acquisitions Stocks

Create a media list. Identify the best contact person for each magazine/journal. Identify the most powerful elements of your article. Prepare a script for your elevator pitch. Practice and refine your elevator pitch. Research each magazine on your list (read their content). Brainstorm article ideas for each magazine on your list.

How to Pitch a Book Idea

PitchBook Simple Example. Uses of Pitch Books. #1 - They are Marketing devices. #2 - Should have Investment Actions well specified. #-3 Contributors. Step by Step Guide to Creating an Investment Banking PitchBook. #1 - Capabilities and Qualifications of the Investment Bank. #2 - Market Updates. #3- Transaction Section.

Picture Book Query Pitch examples of published picture books

60 Examples of Hooks for Books This post collects 60 examples of hooks for books. Also called elevator pitches, these book hooks show real-life examples in a variety of writing genres for fiction and nonfiction books. Robert Lee Brewer Aug 17, 2022

The 10 Steps to Writing a Pitch Book for Institutional Investors by FactorPad YouTube

Key Learning Points Investment banks create pitch books to market their business to clients. The goal is to be chosen by the client to handle a transaction such as buying or selling a company or raising capital. A pitch book for an M&A transaction includes the target's vision, mission, company overview, and business model.